World Habitat Day

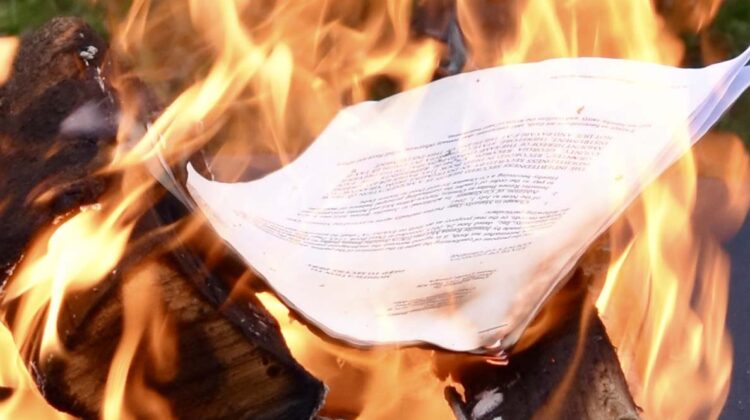

On October 3 we will, along with affiliates across the nation, celebrate World Habitat Day. In Greene County we will have a mortgage burning ceremony. We did this for the first time last year and recognized the four homeowners who have paid off their mortgages – all of them early.

Yes, Habitat homeowners have a mortgage that is held as a security deed on the property, just like most of us. There are two small differences in a Habitat mortgage – differences that are the foundation of the success of the Habitat homeownership program.

First, the mortgage is a no-interest loan. When they repay each month they are paying on the principal of the loan. Unlike a conventional mortgage where you pay interest first and then principal. Each payment they make is on the principal secured by the loan. I like to tell my homeowners every month you own another block of your foundation.

Second, a Habitat mortgage is affordable. If you remember back in 2008, when we had the housing lending crisis, folks were being sold more house than they could afford and eventually there were massive foreclosures.

A Habitat mortgage is affordable because the sale price of the home, as determined by an appraisal, is divided into affordability and subsidy. The homeowner’s mortgage is 30% of their gross income. The remainder of the value of the home is secured by a home equity deed which is “silent” as long as the first is paid.

So, on October 3 we celebrate our fifth completed mortgage, a mortgage that was paid off over two years early! Look for more information on our home page.